Digital Ecosystems and Information Security Services to Drive Telco Revenues in Russia

CSPs predict stable growth for the Russian telecom market over the next five years. The main technologies contributing to this growth will be traditional and generative AI, as well as a microservices architecture.

The Russian telecom industry has undergone many changes in recent years. Some of them are similar to those faced by communications service providers (CSPs) worldwide, such as the importance of finding new revenue streams beyond connectivity. In turn, other challenges are unique: geopolitical and regulatory changes call for a renewed focus on domestic telecom solutions.

At the NexSummIT 2024 conference, Nexign surveyed industry experts to assess their opinions about the telecom market’s present and future in Russia and the neighboring CIS countries – from business and technological perspectives. Another objective was to evaluate the share of domestic and foreign IT solutions in the BSS and core network systems used by CSPs. The survey’s participants included representatives of the largest telecom operators in Russia and the CIS countries (Belarus, Uzbekistan, and Tajikistan). The respondents were top managers: CIOs and CTOs (40%), business development directors (37%), and heads of network operations and maintenance (17%).

Stable Telecom Market Growth Sets to Continue

According to the survey results, CSPs are optimistic about the future of the telecom industry in Russia. Most respondents (57%) forecast annual market growth of 5-10%, and 30% expect growth of more than 30% in the next five years.

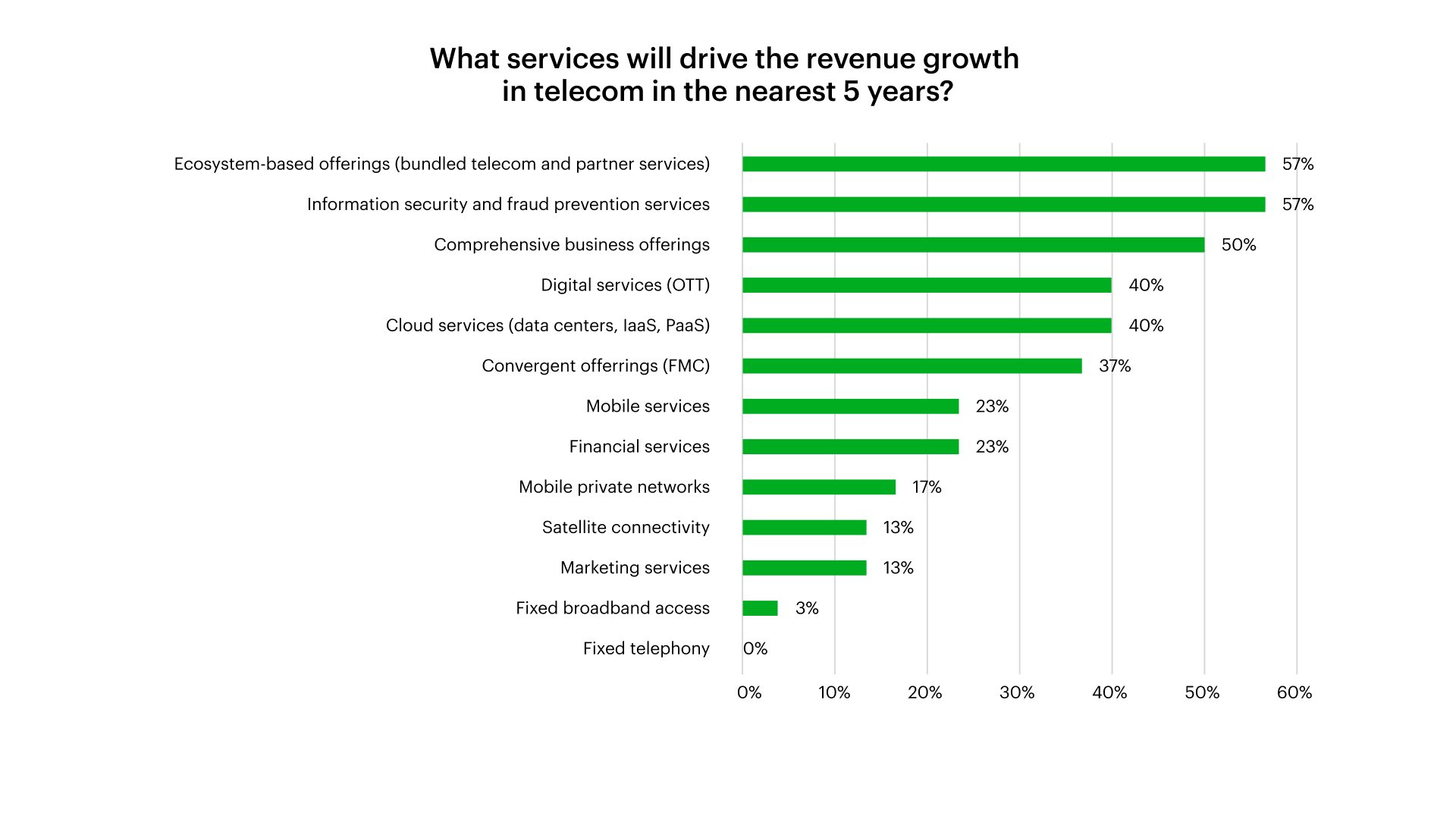

The figures demonstrate the industry’s dynamism, as compared to the Analysis Mason’s forecast of 1% CAGR (between 2023 and 2028) for global telecom service revenues. According to CSPs, the primary growth in the next five years will come from digital ecosystems that bundle the telecom and partner services, information security and fraud prevention services, as well as end-to-end business services. The B2B sector is the main revenue focus for CSPs not only in Russia, but also in other markets. According to TM Forum, worldwide B2B revenues are growing faster than B2C: 5.6% versus 1.6% in 2022 compared to 2021. Based on the statistics of the leading CSPs in Russia, the B2B services are already delivering 10-30% CAGR. They include all-in-one connectivity, cloud, cybersecurity, data analytics, and marketing services.

To harness the partnerships with B2B and B2G customers, MegaFon ProBusiness relies on its 30 years of experience, market dynamics, and individual customer needs. Business in Russia has become more digitalized and readier for technological transformation. It is confirmed by our statistics on demand for B2B services and the revenue dynamics in this sector. Growth will continue, and CSPs will expand their digital service portfolios, increasing their functionality and applicability to different use cases.

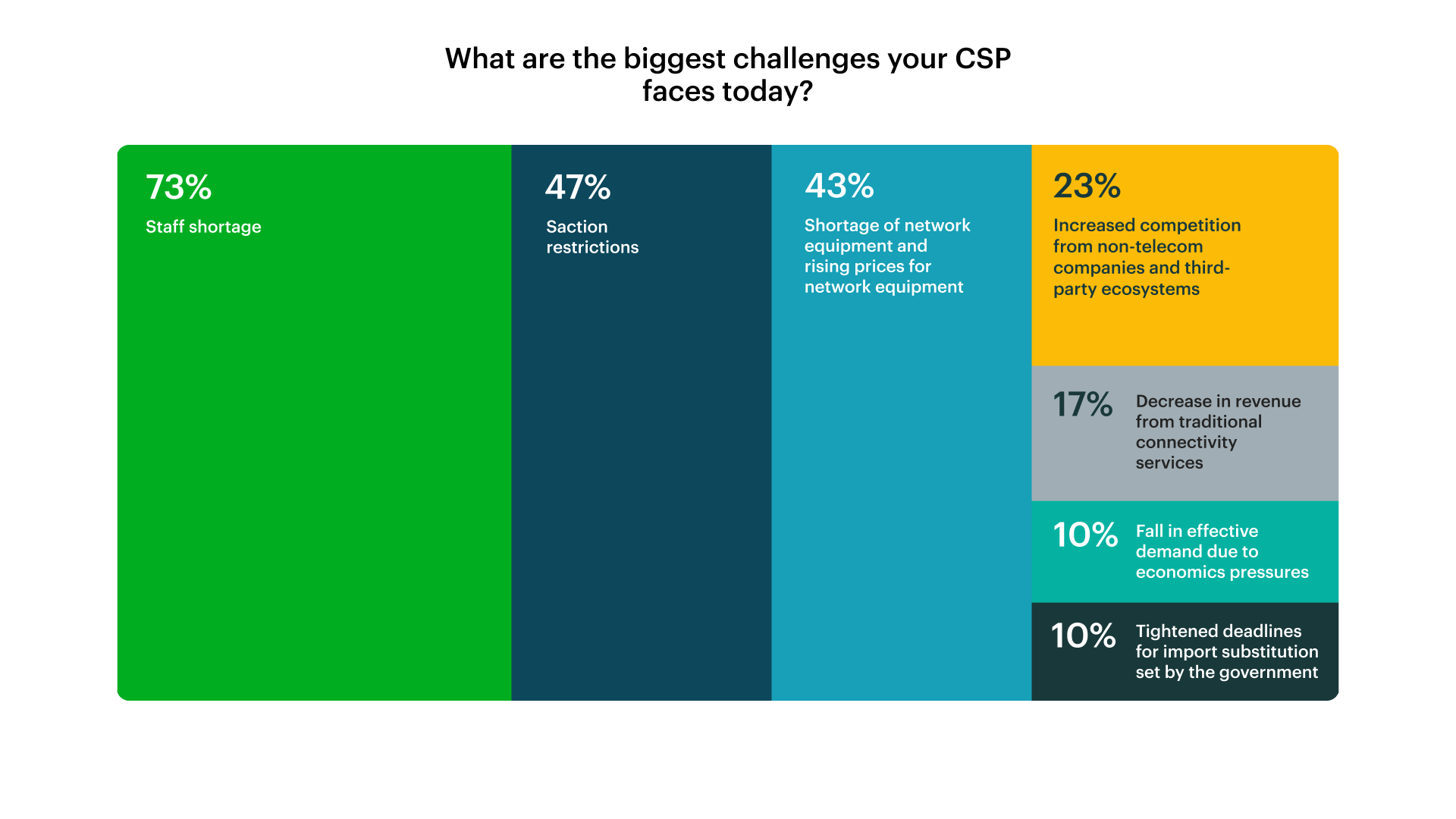

When asked about the industry’s current challenges, 73% of respondents reported staff shortage as the primary negative factor affecting their business. This result is not surprising: the shortage of highly skilled professionals, especially in IT and cybersecurity, has been one of the key challenges for CSPs over the past few years. To address this problem, companies have adopted various strategies, including more competitive remuneration packages and the use of AI in software development and data processing.

Restrictions caused by sanctions (47%), as well as the resulting shortage of network equipment and increased prices (43%), are other crucial issues affecting the telecom business identified by respondents. In 2022, most global telecom vendors left the Russian market and stopped supporting their systems. At that time, up to 90% of core network systems and RAN were based on their products. It left CSPs in a difficult situation but also boosted the local IT market growth. To support and smoothen the shift to domestic solutions, the regulator has been undertaking certain measures and issuing laws that protect the stability and security of the country's critical information infrastructure.

Level of Import Substitution Varies Between IT Systems

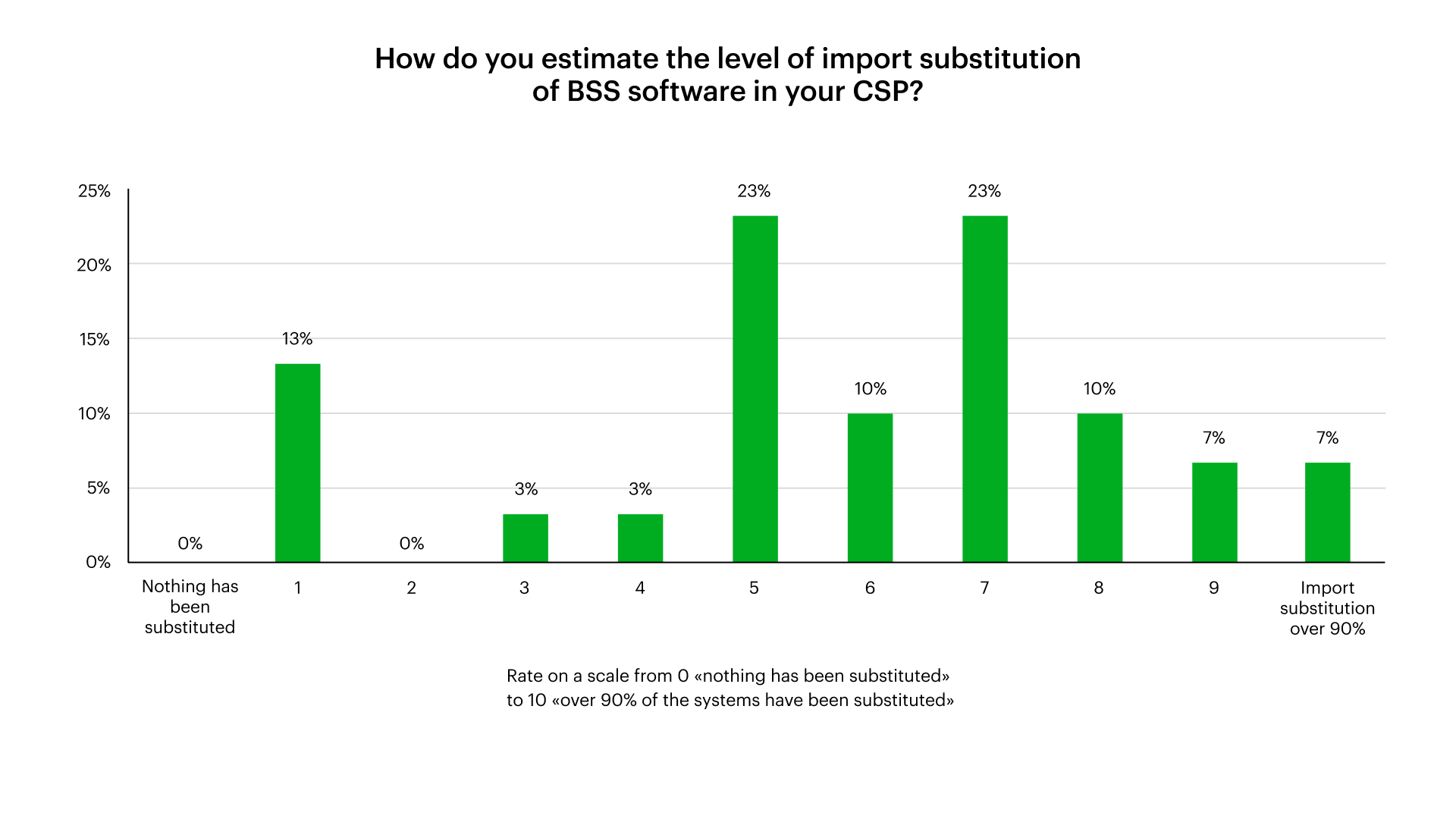

CSPs reported a fairly high level of import substitution of BSS systems in their companies, with 23% of respondents rating it between 5 and 7 on a scale of 0 ('nothing has been substituted') to 10 ('more than 90% has been substituted'). Similarly, 7% of respondents, including CSPs from the Big Four (the term used for the four largest Russian mobile operators — MTS, MegaFon, T2 (ex-Tele2), Beeline), rated the level of import substitution at 10. These results are not surprising. Historically, BSSs in Russia have been developed locally, and there are strong local vendors of such systems. Nexign, for example, has more than 30 years of experience in BSS transformation for the leading CSPs in Russia and the CIS countries.

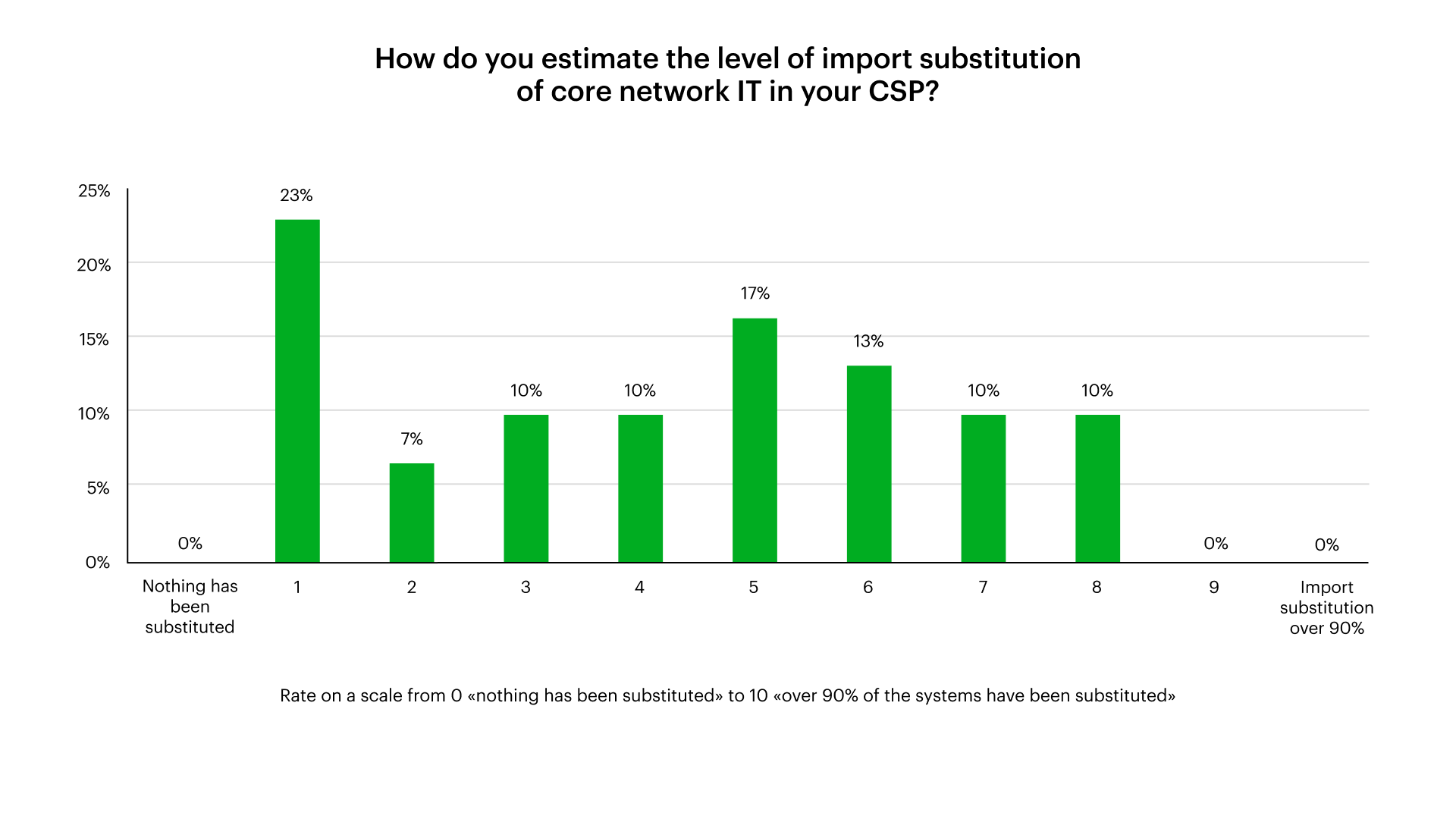

In the core network area, the import substitution situation is different. Most respondents (23%) rated the level of import substitution in their core network systems as 1 on a scale of 0 to 10. None of the respondents chose the option 'nothing has been substituted' and 'more than 90% has been substituted'. These results reflect the state of import substitution in the industry: initially, companies sought to replace the most in-demand systems with discontinued support from vendors to maintain business efficiency and continuity. Now, domestic vendors are focusing on more specialized software and hardware that require a high level of expertise and take more development time. In telecommunications, they include core network and RAN solutions. The first Russian products in these areas are emerging on the market, and a roadmap has been drawn. According to the Telecom Development Strategy 2035, CSPs are required to roll out 5G in all Russian cities with populations over 100,000 people by 2035 — using only Russian network solutions. They must also replace all foreign core network and RAN solutions in their LTE networks by 2030. The government supports this transition by providing subsidies and organizing expert communities.

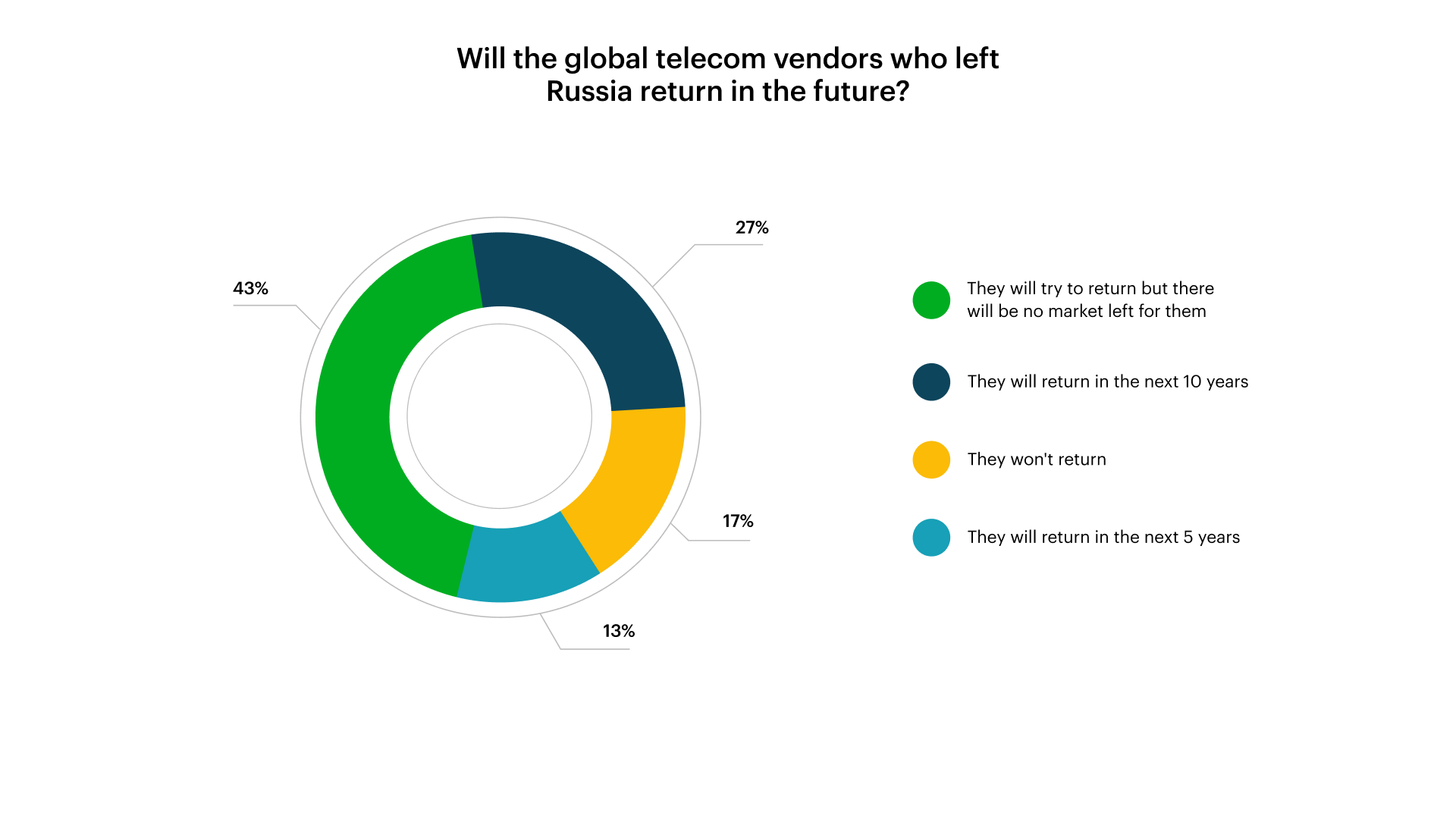

The Nexign survey also shows that CSPs do not believe in the return of global telecom vendors. 43% of respondents are confident that these companies will try to return, but the market will already be occupied by alternative domestic solutions. Given the growth rates of the domestic telecom software and hardware market and the regulatory deadlines for import substitution, these expectations are not surprising.

The high proportion of local BSS solutions deployed by the Russian CSPs, as shown in our survey, proves the fact that there are strong BSS vendors in the country. Of course, there is still work to be done, not regarding the BSS themselves, but the supporting software, such as DBMS and operating systems. Many BSSs still run on Oracle and Windows, and we need full localization. Nexign already offers database-agnostic BSS, which supports a wide range of operating systems. At the same time, the situation is challenging in the core network, where most CSPs still use E2E solutions from Huawei, Ericsson, Nokia, and Oracle. As part of the country’s critical IT infrastructure, telecom operators know that import substitution regulations will be tightened in the foreseeable future. Therefore, we are constantly in touch with the industry and discuss with leading market players their needs in the area of our expertise — such as BSS and network monetization solutions — to ensure a smooth and uninterrupted migration to Russian IT products.

Telecom is Betting on AI

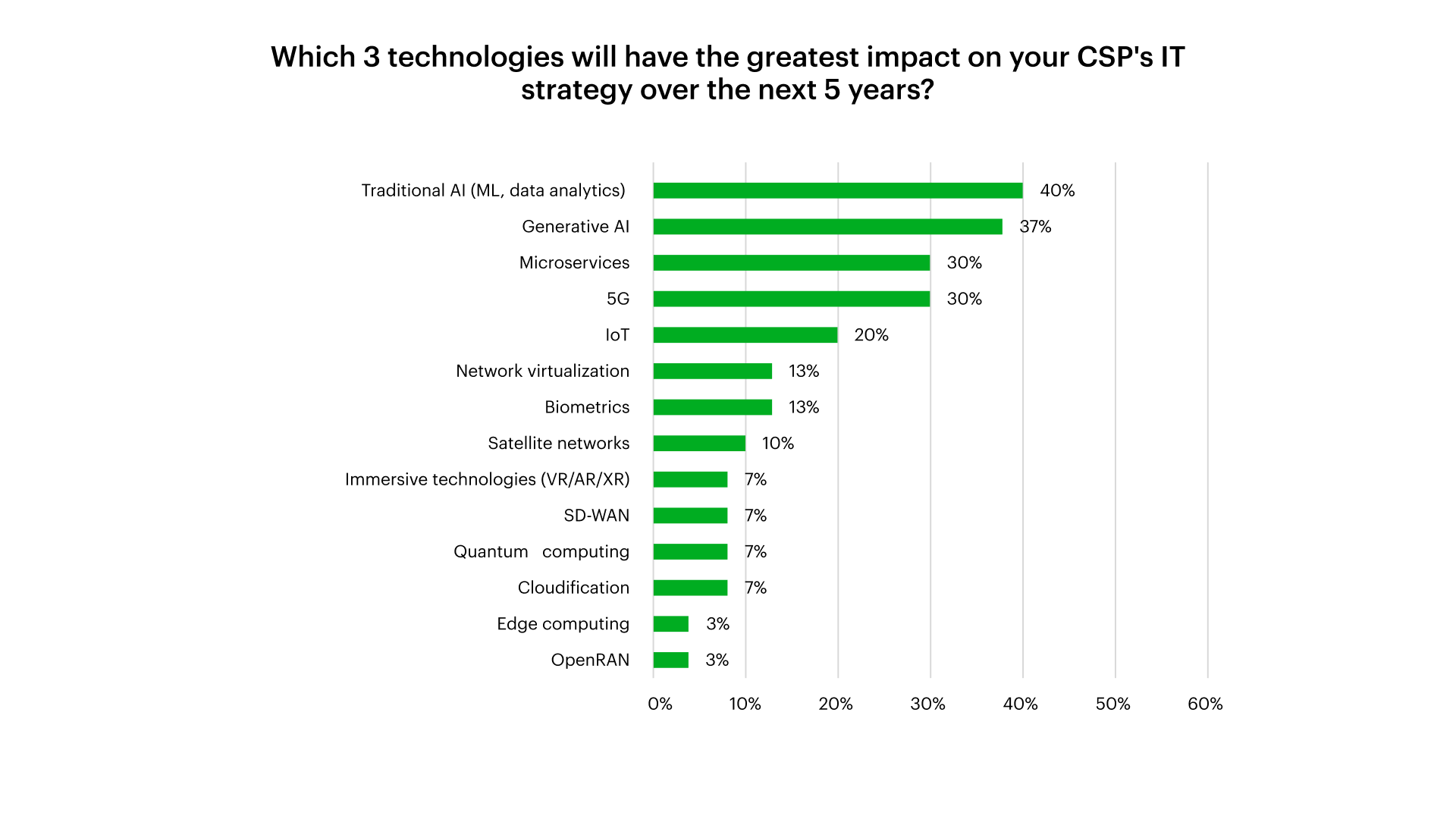

Among the top 3 key technologies that will have the greatest impact on their company's IT strategy in the next five years, CSPs highlighted traditional AI, including machine learning and predictive analytics (50%), generative AI (40%), and microservices architecture (37%). Interestingly, OpenRAN technologies actively promoted by leading telecom equipment vendors in the international market were considered the least interesting, with only 3% of respondents selecting this technology.

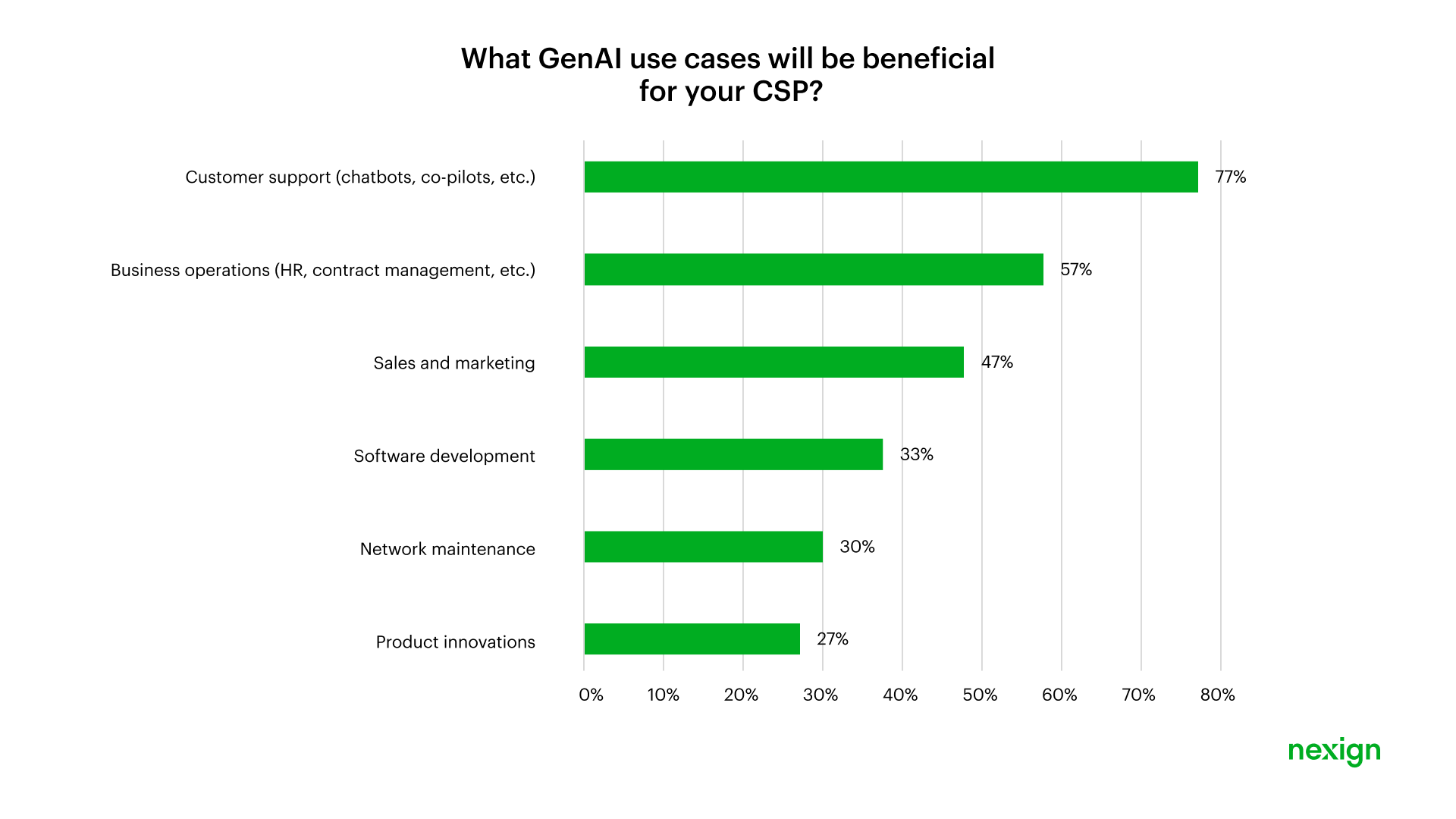

As expected, most respondents (77%) view customer support with AI-assisted chatbots and copilots as the most promising GenAI use case in the telecom business. CSPs also plan to use generative AI to support business operations, such as automating HR functions and contract management.

5G Development in Russia Is Ambiguous

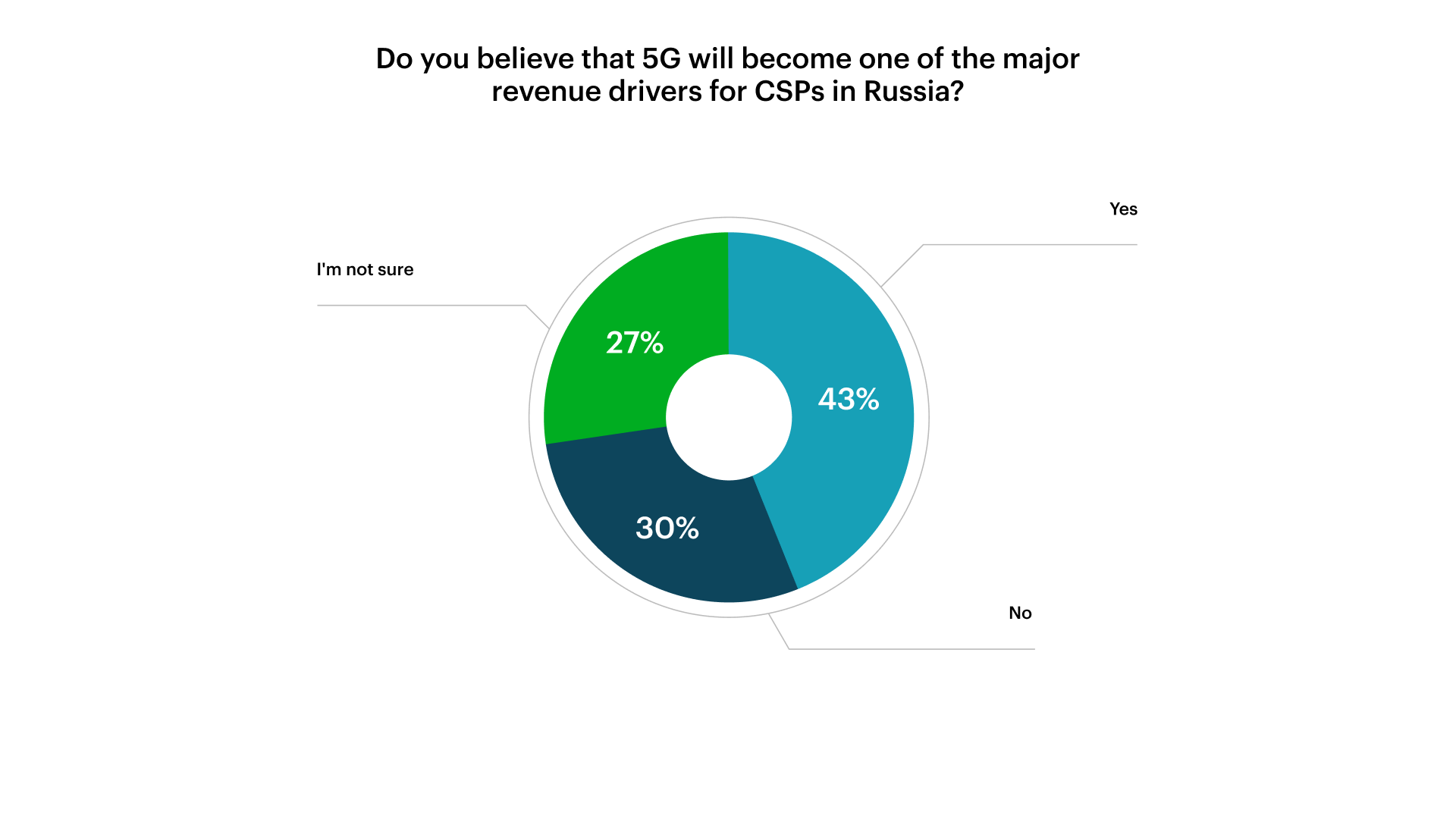

5G is a major technology developed and deployed by the global telecom industry. However, this survey shows that it is not among the top business enablers for the Russian telecom market over the next five years. CSPs' opinions on the prospects of 5G development in Russia also differ. Most respondents (43%) believe that the rollout of 5G will help generate new revenues, but 30% doubt it. As mentioned above, CSPs are required to use only Russian solutions to launch 5G. Domestic CSPs and vendors are already running proof-of-concepts and pilots, but there are no commercial launches of the 5G technology yet. The question of spectrum availability also remains open. Now, the most optimal 5G spectrum (3.4-3.8 GHz) is reserved for the military and security agencies, while CSPs are offered to use the 4.4-4.99 GHz range.

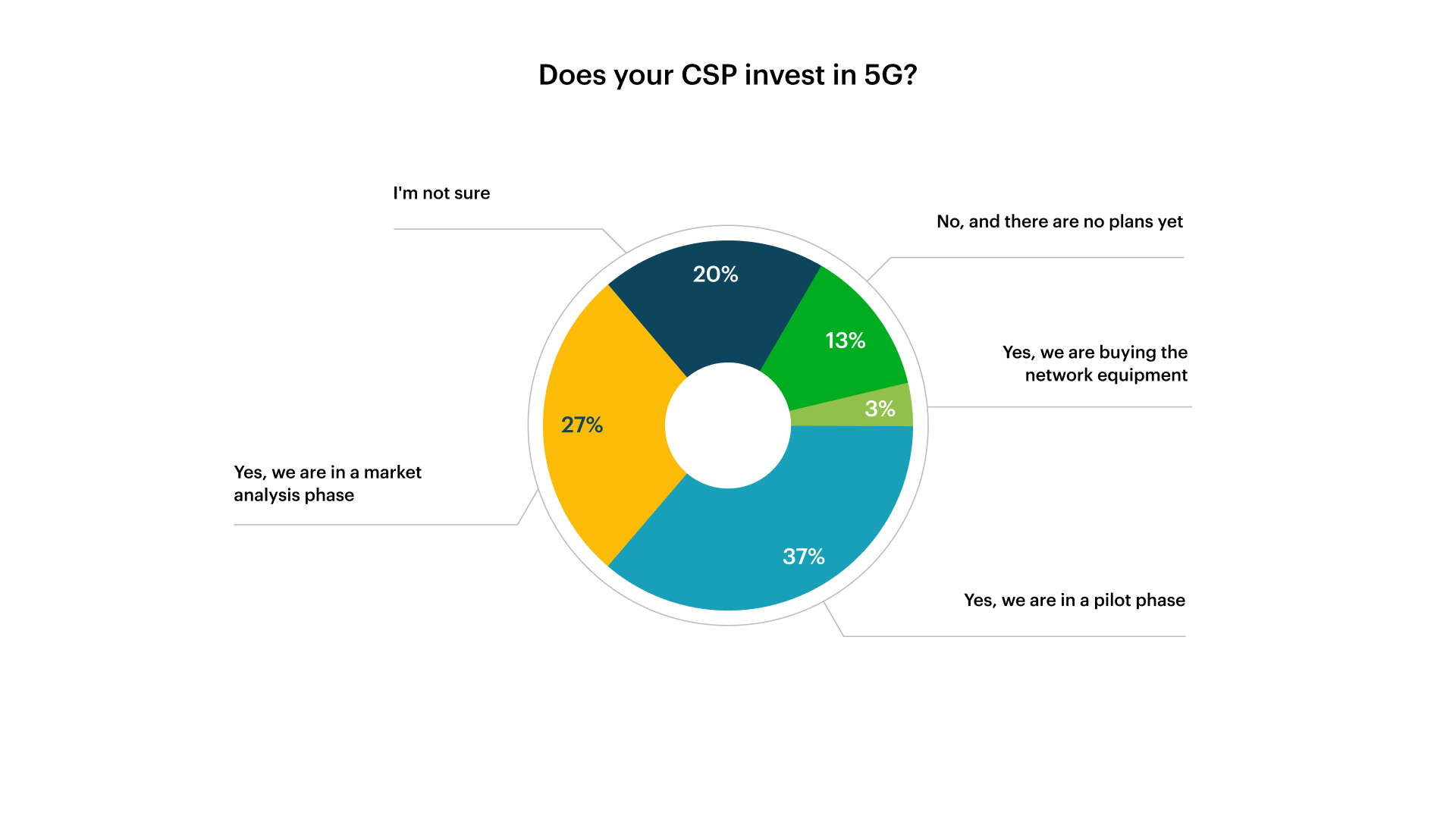

At the same time, CSPs are already investing in 5G: some are in the technology analysis phase, while others are buying the network equipment and already piloting the technology. According to the GSMA's Mobile Economy report, 585 telecom operators in 175 countries are investing in 5G technologies in 2024, and 49 have already launched 5G SA. Today, 5G accounts for more than 1.6 billion (18%) of global connections — by 2030, this figure will reach 56%, and 5G's contribute up to $930 billion to the global economy.

5G offers much faster mobile data speeds and higher capacity. Due to the slicing technology enabled by 5G Standalone, CSPs will be able to introduce new services, for example, to offer mobile plans based on a differentiated or guaranteed quality of service (QoS) to enterprises or promising B2C customer segments, such as gamers, bloggers, and remote workers. Although Russian CSPs haven’t deployed 5G yet, the technology is already commercially available in our neighboring CIS countries. It is worth noting that Russian IT solutions are also being used in several 5G deployments. For example, recently, Nexign and Ucell, the leading telecom operator in Uzbekistan, were among the first in the country to test the 5G Standalone network. Therefore, after 5G’s launch in Russia, CSPs and vendors will be able to build on the positive experiences of countries already using it to generate new revenues.

As the research has shown, the Russian telecom market continues to develop dynamically. Nexign regularly monitors its key trends and considers them when building its product portfolio roadmap.